Levinity: the invoicing tool

Levinity is a complex invoicing tool that allows you to invoice worldwide. Are you looking for an invoice builder? You are right here!

Read more PricingLevinity is a complex invoicing tool that allows you to invoice worldwide. Are you looking for an invoice builder? You are right here!

Read more Pricing

"A tool is an instrument used for processing something, carring out a specific activity, or acheiving certain results. A tool is usually tied to a specific technique, procedure, or process. It assists the user, but it does not do everything for them."

Levinity is a complex and versatile tool that can be adapted to all kinds of situations. It will make your life easier if you give it the right instructions. It's a collaboration between you and Levinity.

It is $15 / month.*

unlimited customers in the invoices

unlimited customers in the invoices

You can purchase additional users when buying a plan.

Or at any time in your Levinity after purchasing a plan.

It is $30 / month.*

ideal up to 500 / per month

ideal up to 500 / per month

*The price may be different in each country. It depends on the fees and taxes in each state. You will find out your final price at checkout.

No, definitely not.

No. You only pay for what you order. The initial setup is included in the price.

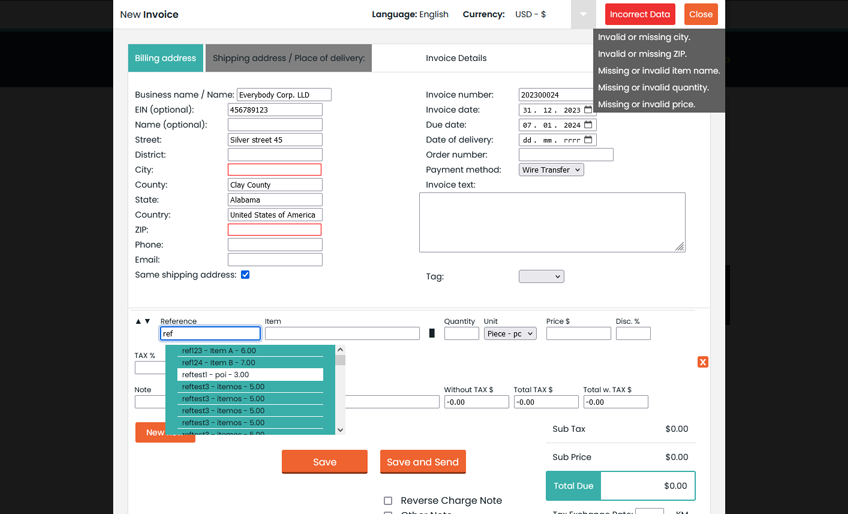

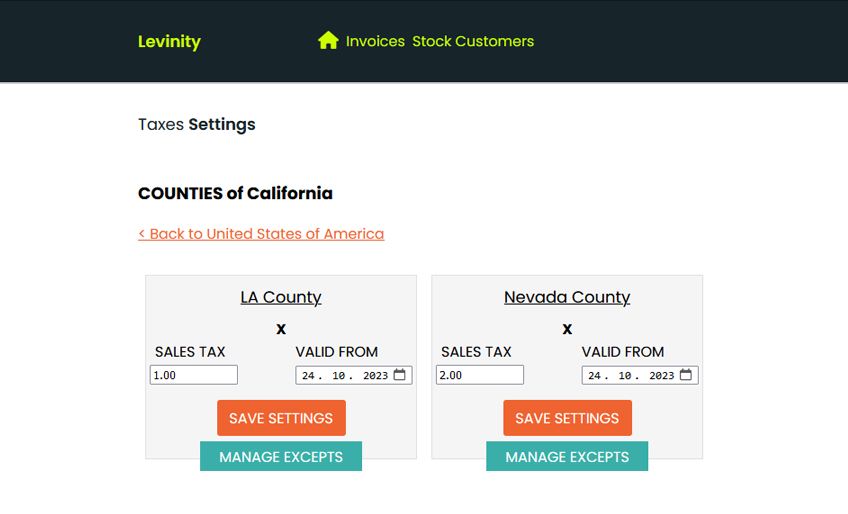

Yes, the tool was designed based on the complex system in the USA. You can manage sales TAX (i) and exceptions for individual states, counties (provinces), cities, and districts. You can manage sales TAX (i) for goods and services too. Additionally, you can manage sales TAX (i) based on the number of items sold or specific time period (such as tax holidays). The sales TAX (i) settings remain saved. Whenever you insert a item into the invoice, the sales TAX (i) is automatically added. You no longer need to worry about filling it out.

Do you want to ask something about Levinity, its features, ordering or anything else?

Are you missing a feature or do you think something could work better?

Is there anything not working properly? Did you find something that is not true?

For each suggestion for improvement or correction that I apply to the system, I will extend your plan for a fixed period for free. Why? Because it is fair. Bye, Andy

Please check all fields and agree to the privacy policy.